Desiree Throckmorton, SPHR

Desiree Throckmorton is a seasoned HR compliance professional with over two decades of experience, including significant tenure at a Fortune 500 company. In her current role as VP I-9 Operations, Senior Consultant, she provides expert guidance to enterprise-level clients on critical issues such as Form I-9 compliance, non-discrimination analysis, and best practices for pay equity and transparency. Throughout her career, Desiree has demonstrated exceptional proficiency in conducting internal proactive audits and managing external reactive audits. She has a keen eye for identifying risk areas in recruitment practices and excels in performing adverse impact analyses on employment decisions. Additionally, Desiree has successfully launched comprehensive, enterprise-wide training programs focused on Equal Employment Opportunity and Form I-9 compliance. Desiree holds the SPHR certification and has earned a Bachelor's Degree from California State University and a Master's Degree from Roosevelt University. Refreshing Your I-9 Tools and Process to Stay Compliant

Form I-9 is a federal requirement that carries real consequences if handled improperly. With increased scrutiny on immigration by the current...

Desiree Throckmorton, SPHR

Dec 18, 2025 2:18:51 PM

Refreshing Your I-9 Tools and Process to Stay Compliant

Form I-9 is a federal requirement that carries real consequences if handled improperly. With increased scrutiny on immigration by the current...

Desiree Throckmorton, SPHR

Dec 18, 2025 2:18:51 PM

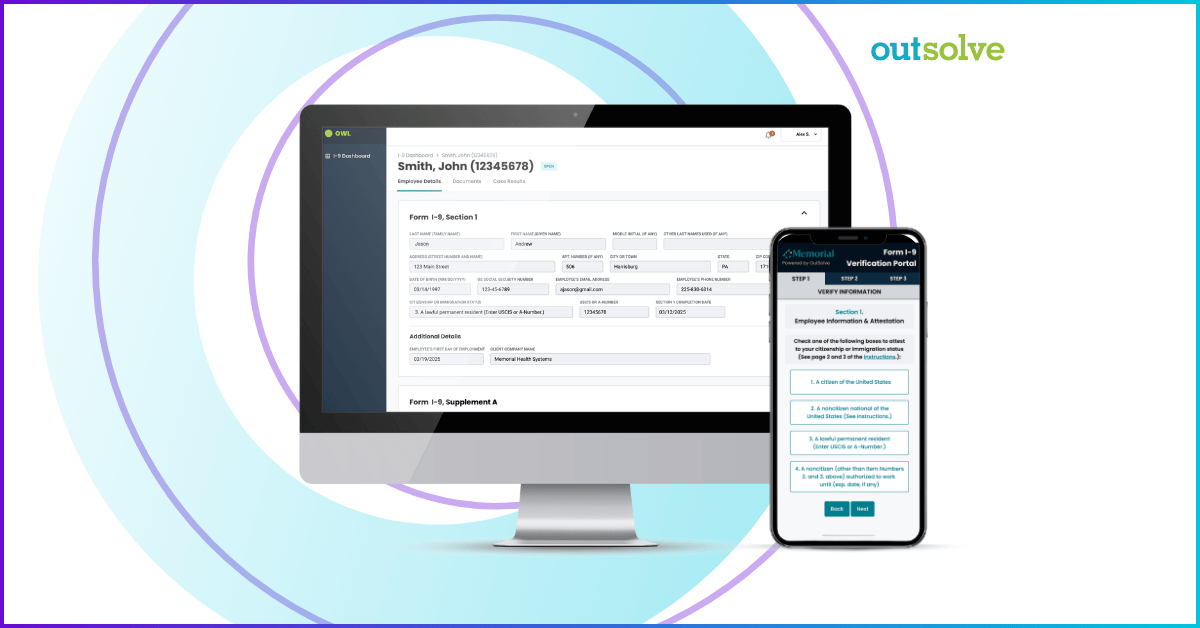

Form I-9 is a federal requirement that carries real consequences if handled improperly. With increased scrutiny on immigration by the current presidential administration and steeper penalties for noncompliance, now is the time to take a fresh look at your I-9 process to make sure you would be ready for an audit if ICE came knocking.

Desiree Throckmorton, SPHR Refreshing Your I-9 Tools and Process to Stay Compliant E-Verify Requirements Across the States

HR Teams are always trying to do it all—we’re compliance partners, onboarding experts, and often the first line of defense in making sure our...

Desiree Throckmorton, SPHR

Oct 28, 2025 8:15:00 AM

E-Verify Requirements Across the States

HR Teams are always trying to do it all—we’re compliance partners, onboarding experts, and often the first line of defense in making sure our...

Desiree Throckmorton, SPHR

Oct 28, 2025 8:15:00 AM

HR Teams are always trying to do it all—we’re compliance partners, onboarding experts, and often the first line of defense in making sure our organizations don’t run afoul of employment laws. One area that’s growing increasingly complex, especially for multi-state or hybrid employers, is Form I-9 and E-Verify compliance.

Desiree Throckmorton, SPHR E-Verify Requirements Across the States I-9 Compliance: What Employers Need to Know

Ensuring compliance with employment work authorization requirements is a crucial responsibility for employers. A Form I-9 is the official document...

Desiree Throckmorton, SPHR

Sep 8, 2025 11:00:00 AM

I-9 Compliance: What Employers Need to Know

Ensuring compliance with employment work authorization requirements is a crucial responsibility for employers. A Form I-9 is the official document...

Desiree Throckmorton, SPHR

Sep 8, 2025 11:00:00 AM

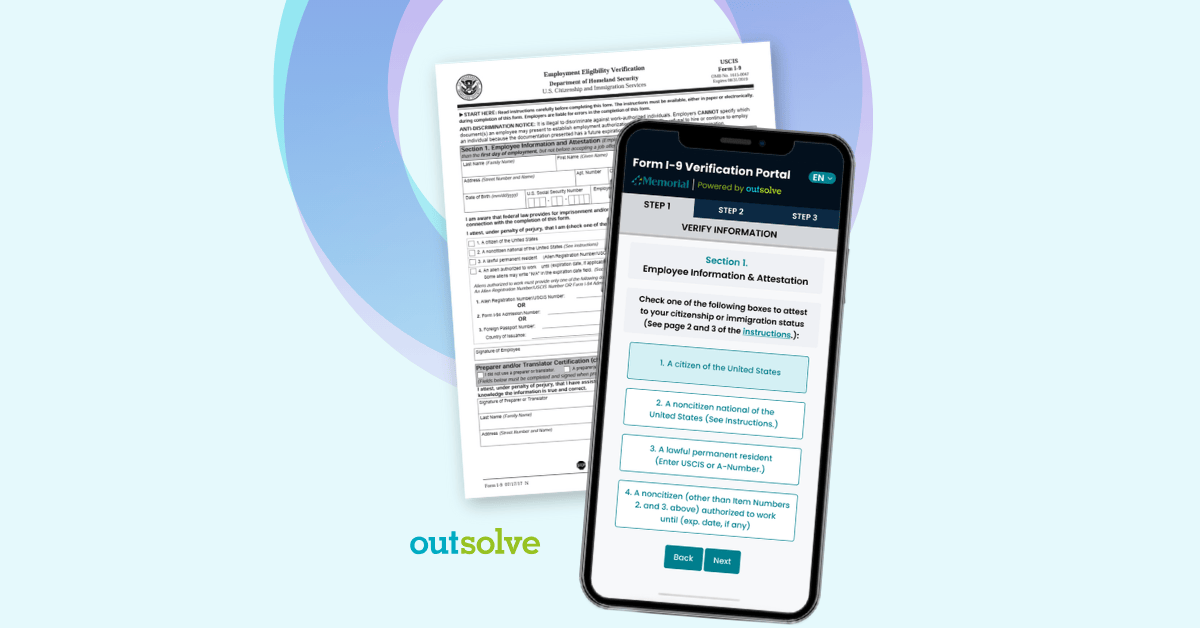

Ensuring compliance with employment work authorization requirements is a crucial responsibility for employers. A Form I-9 is the official document required by United States law that employers use to verify the identity and employment eligibility of individuals hired to work in the United States.

Desiree Throckmorton, SPHR I-9 Compliance: What Employers Need to Know Electronic I-9 vs. Paper I-9 Form: Benefits of Going Digital

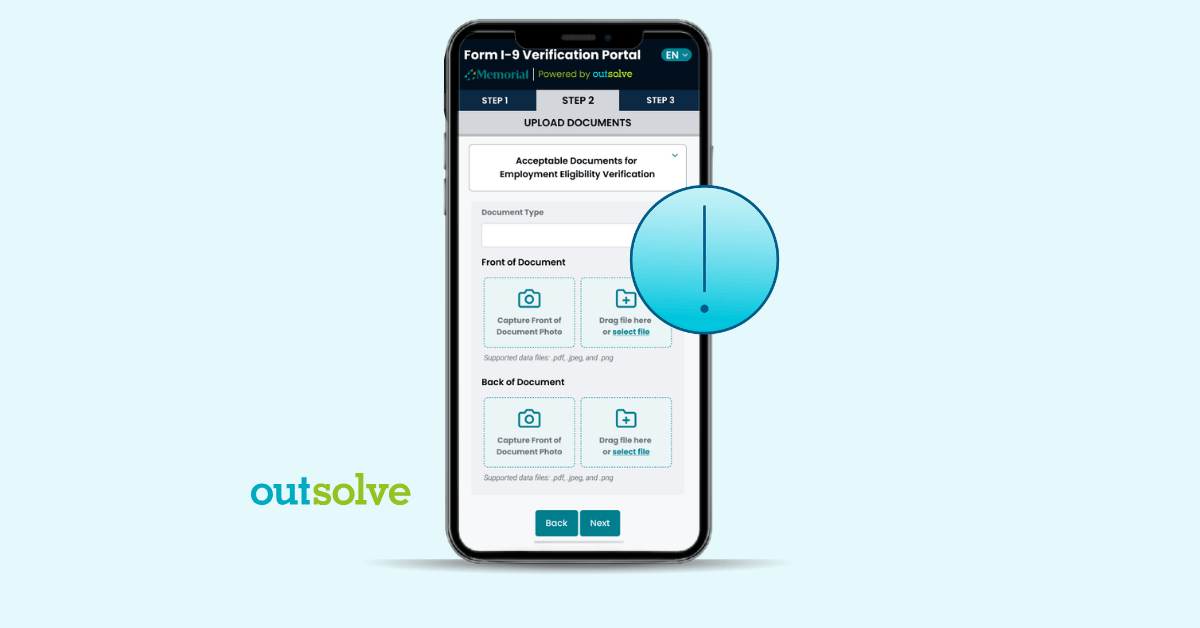

HR teams know all too well that compliance is a constant and critical part of daily work. Ensuring accuracy is essential to avoiding both financial...

Desiree Throckmorton, SPHR

Aug 27, 2025 3:43:21 PM

Electronic I-9 vs. Paper I-9 Form: Benefits of Going Digital

HR teams know all too well that compliance is a constant and critical part of daily work. Ensuring accuracy is essential to avoiding both financial...

Desiree Throckmorton, SPHR

Aug 27, 2025 3:43:21 PM

HR teams know all too well that compliance is a constant and critical part of daily work. Ensuring accuracy is essential to avoiding both financial and reputational penalties and damage. In 2025, few documents make the case more compelling than Form I-9—a legally required task in every new hire packet since 1986, and a clear reminder of the importance of compliance. Whether you’ve completed hundreds of Form I-9s or are just getting started, you understand the importance of properly verifying a new employee’s identity and employment eligibility.

Desiree Throckmorton, SPHR Electronic I-9 vs. Paper I-9 Form: Benefits of Going Digital Common I-9 Errors and How to Correct Them

If you’ve worked in Human Resources long enough, then chances are you’ve had at least one moment of panic over Form I-9! Whether it was an incomplete...

Desiree Throckmorton, SPHR

Aug 18, 2025 3:35:11 PM

Common I-9 Errors and How to Correct Them

If you’ve worked in Human Resources long enough, then chances are you’ve had at least one moment of panic over Form I-9! Whether it was an incomplete...

Desiree Throckmorton, SPHR

Aug 18, 2025 3:35:11 PM

If you’ve worked in Human Resources long enough, then chances are you’ve had at least one moment of panic over Form I-9! Whether it was an incomplete form, a mismatched document number, or a reverification oversight, I-9 errors are surprisingly common, but potentially costly.

Desiree Throckmorton, SPHR Common I-9 Errors and How to Correct Them I-9 Audit Checklist: Don’t Risk an Audit

I-9 Audits: If you work in HR, the threat of a Form I-9 audit is a real concern—but it’s also an opportunity to take control. With the current...

Desiree Throckmorton, SPHR

Aug 4, 2025 3:21:57 PM

I-9 Audit Checklist: Don’t Risk an Audit

I-9 Audits: If you work in HR, the threat of a Form I-9 audit is a real concern—but it’s also an opportunity to take control. With the current...

Desiree Throckmorton, SPHR

Aug 4, 2025 3:21:57 PM

I-9 Audits: If you work in HR, the threat of a Form I-9 audit is a real concern—but it’s also an opportunity to take control. With the current administration intensifying immigration enforcement, now is the time to strengthen your I-9 processes, close compliance gaps, and ensure your documentation is audit-ready.

Desiree Throckmorton, SPHR I-9 Audit Checklist: Don’t Risk an Audit I-9 Documents: What to Do When Employee Verification Looks Questionable

Flawed I-9 documents can compromise years of otherwise sound compliance efforts, opening the door to legal exposure and financial penalties. Federal...

Desiree Throckmorton, SPHR

Jul 28, 2025 2:25:59 PM

I-9 Documents: What to Do When Employee Verification Looks Questionable

Flawed I-9 documents can compromise years of otherwise sound compliance efforts, opening the door to legal exposure and financial penalties. Federal...

Desiree Throckmorton, SPHR

Jul 28, 2025 2:25:59 PM

Flawed I-9 documents can compromise years of otherwise sound compliance efforts, opening the door to legal exposure and financial penalties. Federal enforcement is intensifying under the Trump administration with recent anti-DEI executive orders and evolving immigration policies. Employers are under increasing pressure to validate identity and work eligibility with precision and consistency. Even a single misstep can result in costly fines, reputational harm, or a full-scale audit.

Desiree Throckmorton, SPHR I-9 Documents: What to Do When Employee Verification Looks Questionable What is Employment Verification?

You’ve finally settled on the right candidate for your position. Next comes the paperwork and new hire onboarding documents that must be completed....

Desiree Throckmorton, SPHR

Jul 21, 2025 4:03:59 PM

What is Employment Verification?

You’ve finally settled on the right candidate for your position. Next comes the paperwork and new hire onboarding documents that must be completed....

Desiree Throckmorton, SPHR

Jul 21, 2025 4:03:59 PM

You’ve finally settled on the right candidate for your position. Next comes the paperwork and new hire onboarding documents that must be completed. One of the most important, and sometimes overlooked steps of the onboarding process, is ensuring your new employee is eligible to work in the U.S. by having them complete a Form I-9, which is a legal requirement for all employers.

Desiree Throckmorton, SPHR What is Employment Verification? I-9 Documents: What’s Acceptable and Best Practices

The Form I-9 might seem like just another onboarding form, but it plays a crucial legal role in verifying your employees’ right to work in the United...

Desiree Throckmorton, SPHR

Jul 8, 2025 4:25:35 PM

I-9 Documents: What’s Acceptable and Best Practices

The Form I-9 might seem like just another onboarding form, but it plays a crucial legal role in verifying your employees’ right to work in the United...

Desiree Throckmorton, SPHR

Jul 8, 2025 4:25:35 PM

The Form I-9 might seem like just another onboarding form, but it plays a crucial legal role in verifying your employees’ right to work in the United States. With shifting rules and strict documentation standards, staying compliant isn’t always easy.

Desiree Throckmorton, SPHR I-9 Documents: What’s Acceptable and Best Practices Form I-9 Reverification: What Is It and Who Needs It for Compliance?

Human Resources professionals juggle a long list of responsibilities from recruiting and onboarding to benefits management and legal compliance, the...

Desiree Throckmorton, SPHR

Jun 11, 2025 11:28:41 AM

Form I-9 Reverification: What Is It and Who Needs It for Compliance?

Human Resources professionals juggle a long list of responsibilities from recruiting and onboarding to benefits management and legal compliance, the...

Desiree Throckmorton, SPHR

Jun 11, 2025 11:28:41 AM

Human Resources professionals juggle a long list of responsibilities from recruiting and onboarding to benefits management and legal compliance, the list goes on. One critical, and often overlooked, piece that relates to compliance is Form I-9 reverification. Though only a few reverifications might be required per year, failing to properly complete reverification can lead to fines, and even legal trouble.

Desiree Throckmorton, SPHR Form I-9 Reverification: What Is It and Who Needs It for Compliance?Need More Help? Contact OutSolve.

We offer HR compliance, anti-discrimination, and fair pay solutions.

.png)