1 min read

California Pay Data Reporting Deadline Approaching - DFEH Updates User Guide

![]() OutSolve

:

Mar 8, 2022 6:45:00 AM

OutSolve

:

Mar 8, 2022 6:45:00 AM

-1.png)

The deadline to file 2021 pay data reports is April 1, 2022, instead of March 31st

The California Department of Fair Employment and Housing (DFEH) has posted updates to its California Pay Data Reporting Portal which includes the User Guide for the 2021 reporting. The California Pay Data Reporting landing page also provides links to the Pay Data Reporting portal, user guide, Excel template, CSV example, FAQs, and pay data-related questions.

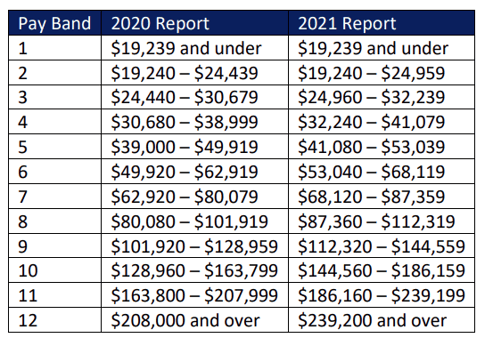

As indicated in the user guide, the “top five changes from the 2020 report” include:

1. New filing deadline of April 1, 2022, with no deferral period. The previous filing deadline of March 31st was changed since it is Cesar Chavez Day, a holiday in California.

2. The Pay Data Report requires employers to group their employees by job category, pay band, race, ethnicity, and sex and report to DFEH the number of employees within each group and the total hours worked by the employees in that group. The updated pay bands, established by the Bureau of Labor Statistics, are as follows:

3. New registration process with the ability to view certified reports. Employers that filed the 2020 reports after July 1, 2021, will need to re-register.

4. New interface to upload data. Employer information will be provided through a series of on-screen questions in Section I, whereas, establishment information and employee detail, Section II, will still be provided via a data upload file or manual entry.

5. All reference materials, including the user guide, have been updated for the 2021 Pay Data Report.

OutSolve’s Take

OutSolve’s Take Contractors should take note of these changes in preparation for filing their 2021 pay data report. If you would like assistance with your filing, please contact us here or your OutSolve Consultant directly at 888-414-2410 or info@outsolve.com.

Founded in 1998, OutSolve has evolved into a premier compliance-driven HR advisory firm, leveraging deep expertise to simplify complex regulatory landscapes for businesses of all sizes. With a comprehensive suite of solutions encompassing HR compliance, workforce analytics, and risk mitigation consulting, OutSolve empowers organizations to navigate the intricate world of employment regulations with confidence.

Weekly OutLook

Featured Posts

5 Key Compliance Items HR Can’t Afford to Ignore

HR Compliance Checklist: What Every HR Pro Needs to Know

Related Posts

I-9 Audit Checklist: Don’t Risk an Audit

Employers continue to be held to a higher standard when it comes to Form I-9 compliance, especially due to increased immigration enforcement and...

outRageous HR: HR Plans vs. Reality: Why Execution Falls Apart (and How to Fix It)

We all know the feeling. In Q4, strategic planning is in full swing, and the roadmap for the upcoming year looks pristine. You have a solid...

.png)

Beat the Rush: Outsource Federal Reporting Requirements in Q1

The beginning of the year usually feels like a fresh start that brings new business initiatives, goals, and strategies. The work you do between...