State-Mandated Pay Reporting

easily comply with Pay Data Reporting

Navigate complex pay data requirements with expert guidance and support.

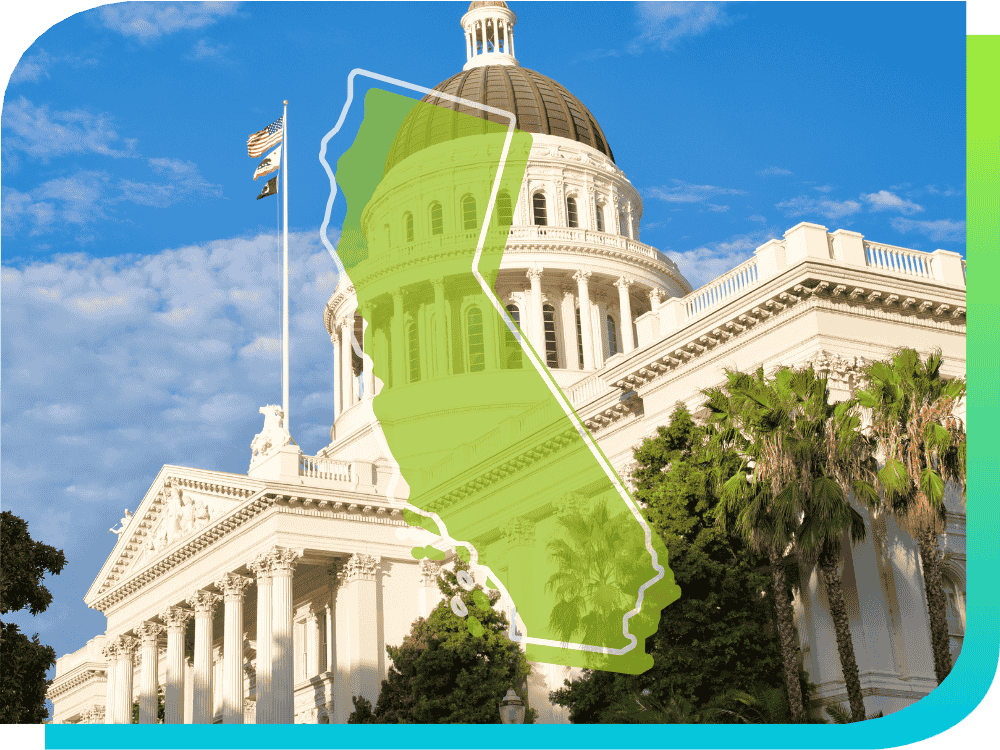

NAVIGATE CA PAY REPORTING

California Pay Data Report

In accordance with California law, private employers with a workforce of 100 or more employees and/or 100 or more workers hired through labor contractors are obligated to submit an annual report to the Civil Rights Department (CRD). OutSolve’s experts can take this task off your to-do list. You can rest assured that your report will be submitted accurately and in compliance with state regulations. You’ll also have an expert by your side guiding you through the nuances of California's pay data reporting requirements.

SIMPLIFY IL PAY REPORTING

Illinois Pay Data Report

SB 1480 was signed into law and later amended by SB 1487 in 2021. The law requires Illinois employers with 100 or more employees to obtain an Equal Pay Registration Certificate among other requirements. The most challenging of employer obligations is the submission of employee pay data. Before submission, Illinois employers should perform a pay equity analysis to avoid potential violations and penalties. OutSolve services include data evaluation, proactive pay analysis, and the submission of the required information to the Illinois DOL on your behalf.